January 1st signaled the start of the new year as well as the start date for a number of new laws, rules, and regulations. Among them is one that will impact business owners utilizing third-party network payment providers, such as PayPal, Venmo, and Zelle and services by which independent contractors like Uber and Lyft received […]

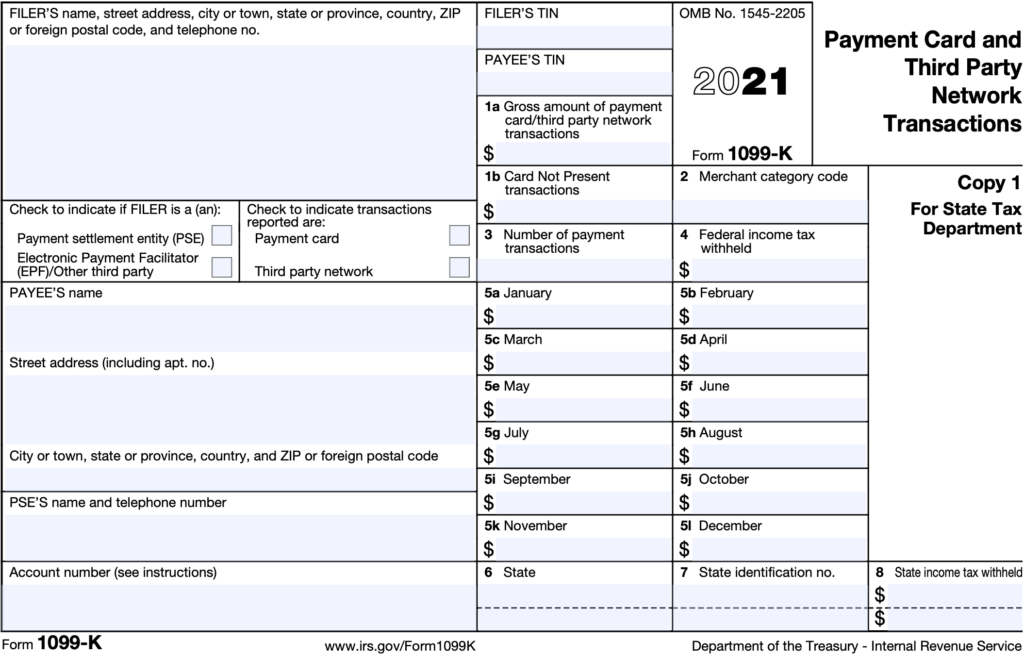

Payment Card and Third Party Network Transactions: 1099-K