January 1st signaled the start of the new year as well as the start date for a number of new laws, rules, and regulations. Among them is one that will impact business owners utilizing third-party network payment providers, such as PayPal, Venmo, and Zelle and services by which independent contractors like Uber and Lyft received third-party payments.

The new rule was signed into law as part of the American Rescue Plan and is intended to ensure third-party app users pay their fair share of taxes. The new law does not create a new tax. Instead, it establishes a change in tax reporting.

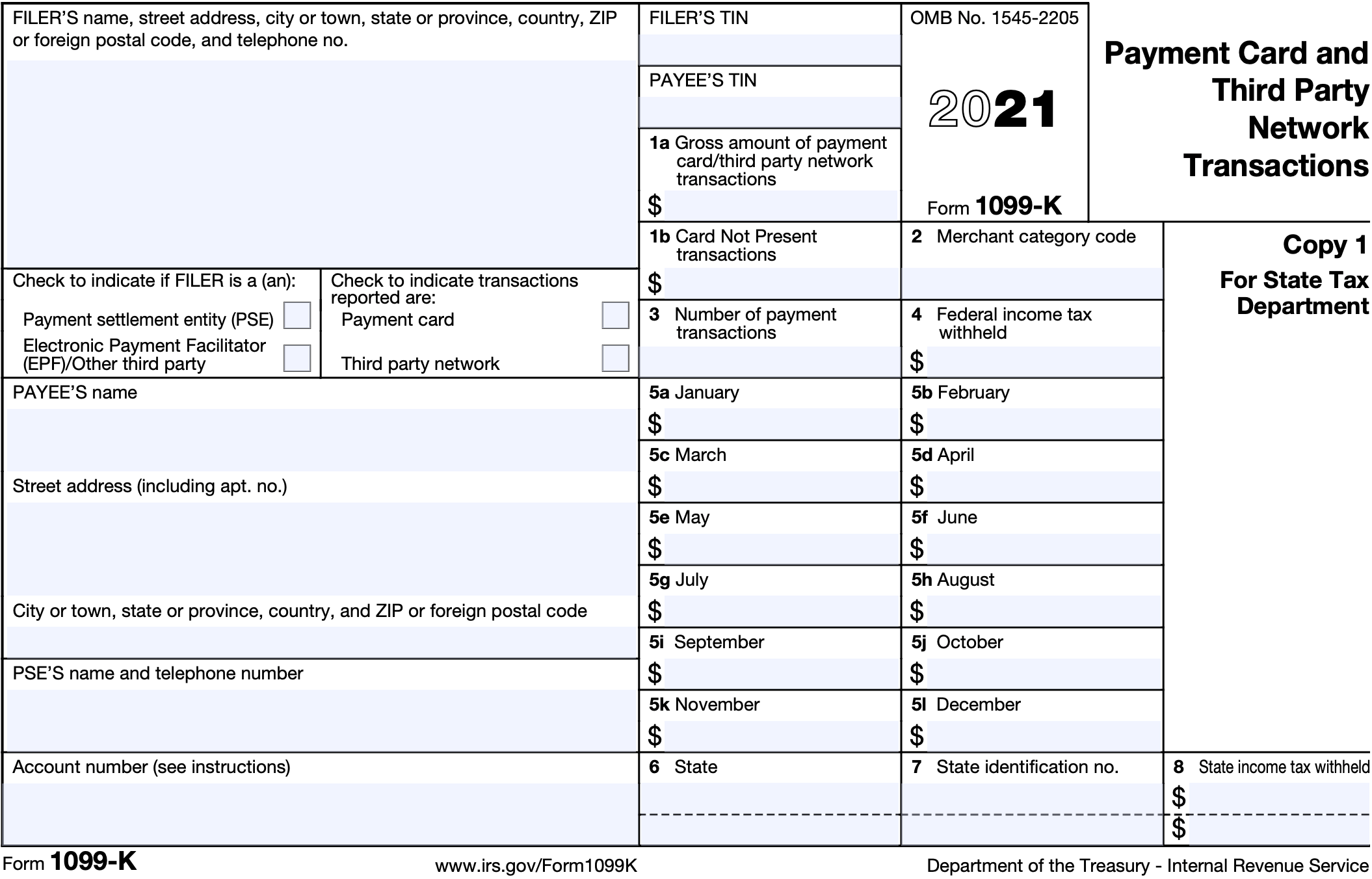

Here is how it will work: Beginning January 1, 2022, taxpayers will start receiving Form 1099-K from third-party network providers for income received through electronic forms of payments, such as credit card transactions and online payments, by January 31 of the following year. As a result, third-party payers may ask for your employer identification number, individual tax identification number or Social Security number so they can properly report your transactions on your Form 1099-K.

Form 1099-K includes both taxable and nontaxable income sources. Taxable sources of income include wages, tips, rental income, and retirement income. Nontaxable income, or income that does not have to be reported on your income tax return, includes money earned by selling personal items via online platforms like Mercari and Poshmark.

Third-party payment services, such as PayPal and Venmo, allow users to tag transactions as personal. So long as a personal transaction is properly categorized, it should not trigger the issuance of a Form 1099-K. This means taxpayers can still use third-party payment services to, for example, split restaurant bills with friends and family; split rent among roommates; and, with siblings, pitch in for gifts for mom and dad.

Focus on the change

Under prior law, third-party payment networks were required to report payments when (1) gross payments exceeded $20,000, and (2) there were more than 200 transactions during the year. The new law requires payment app providers to report users’ business transactions if they total $600 or more for the entire year. The number of individual payments or transactions does not impact this requirement.

The new reporting requirement is also significantly different from the previous tax law in that the new reporting requirement makes business owners who use these platforms keep good records.

Here are two things to do to ensure accurate tax reporting for 2022:

Business owners should set up separate third-party network platform accounts for both their business transactions and their personal purchases. Doing so will help avoid a commingling of taxable and nontaxable transactions reported on Form 1099-K.

Keep track of taxable income by maintaining all financial records and documents relating to the business, including but not limited to bank statements, receipts, and invoices, either electronically or manually.

If you have any questions as it pertains to your situation, please contact our office.