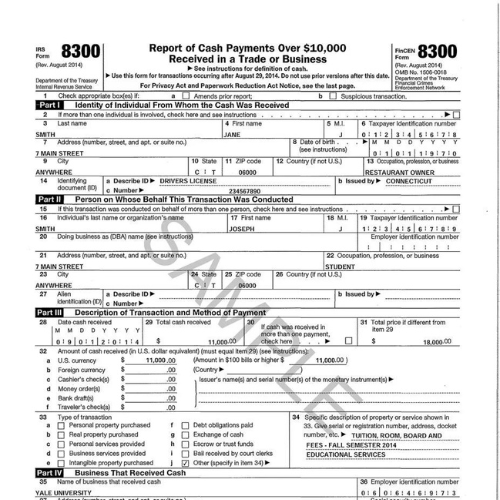

Effective January 1, 2024, businesses with large cash transactions must electronically file Form 8300 when receiving cash payments of $10,000 or greater. This new requirement was recently issued in news guidance IR-2023-157 by the Internal Revenue Service. Generally, if you’re in a trade or business and receive more than $10,000 in cash in a single transaction or in related transactions (i.e. new or used automobile dealerships, marijuana-related businesses), filing a Form 8300 is required. Each time cash payments (whether single or related transactions) add up to more than the threshold amount, subsequently another Form 8300 must be filed. Although many cash transactions are considered legitimate, unfortunately many still are not; as a result, this new requirement will not only assist in the Internal Revenue Service’s continued efforts to expose and hold accountable the tax evaders and/or drug traders but also combat those who finance terrorism.

This new requirement applies to businesses that are required to file at least 10 information returns of one or more types other than Form 8300 in 2024 (such as Forms 1099 series and Forms W-2). For example, if you’re required to file five Forms W-2 and five Forms 1099-INT, then you’re required to file certain other information returns during that year electronically, including any Forms 8300. On the other hand, if you file less than 10 total information returns other than Forms 8300, you’re not required to file the information returns electronically and not required to file any Forms 8300 electronically. The number of Forms 8300 you file does not affect the electronic filing requirement. Also worth mentioning, if you’re not required to electronically file, you still have the option to do so accordingly.

Waivers:

It’s important to note, in those same regulations, some businesses may need to apply for a waiver from the new requirements. A business may file a request for a waiver from electronically filing information returns, including Form 8300, because of undue hardship. However, a business may not request an e-filing waiver that would apply just to Form 8300. The business must include the word “WAIVER” on the center top of each Form 8300 (page 1) when submitting the paper filed return.

Exemptions:

Additionally, filers may request an exemption from filing Form 8300 electronically if using the required technology conflicts with their religious beliefs. In order to claim this exemption, the filer must include the words “RELIGIOUS EXEMPTION” on the center top of each Form 8300 (page 1) when submitting the paper filed return.

Penalty for Paper Filing (when required to e-file):

If you are required to electronically file (e-file) but send in a paper return instead and you don’t have a waiver nor a religious exemption, you will be subject to a failure to file penalty.

Late Returns:

A business must self-identify late returns. A business must file a late Form 8300 in the same way, (either electronically or on paper), as a timely filed Form 8300. A business filing a late Form 8300 electronically must include the word “LATE” in the comments section of the return. A business filing a late Form 8300 on paper must write “LATE” on the center top of each Form 8300 (page 1). Failure to file timely includes a failure to file in the required manner. If you are required to file electronically and failed to do so, Form 8300 would be considered not only late but also because of late filing status, subject to penalty.

Recordkeeping:

A business must keep a copy of every Form 8300 it files, as well as any supporting documentation along with the required statement it sends to customers. These records are to be kept for five years from the date filed. When filing form 8300 electronically, it’s important to note that prior to finalizing the form for submission, businesses will need to save a copy of the form electronically or print a copy of the form. Once submittal is completed, it will provide a confirmation that the form was filed. The confirmation number could then be associated with the saved/printed copy. Confirmation e-mails alone will not suffice in meeting the recordkeeping requirement; therefore, it’s imperative that these forms are electronically saved or printed prior to submittal.

E-filing:

In order to file Form 8300 electronically, a business must set up an account with the Financial Crimes Enforcement Network’s BSA E-Filing System. The IRS will ensure the privacy and security of all taxpayer data. Many businesses have already found the free and secure e-filing system to be a convenient option and cost-effective method to meet the reporting deadline requirement of within 15 days after a transaction (after the person received the cash). Another plus to the process is they receive free email acknowledgment of receipt of the form when they electronically file, which helps keep the guessing out if it was received or not. Additionally, it provides businesses the ability to batch e-file their reports, which is especially helpful to those required to file many forms.

For more information about the reporting requirement, you can reference fact sheet, FS-2023-19, on the IRS.gov website. To further assist businesses with preparing and filing reports, the IRS created two tutorial videos on how to complete form 8300 – Part I, Part II. The short video points out sections of Form 8300 for which the IRS commonly finds mistakes and explains how to accurately complete those sections. For additional information, please contact the IRS Help Line at (866) 270-0733.