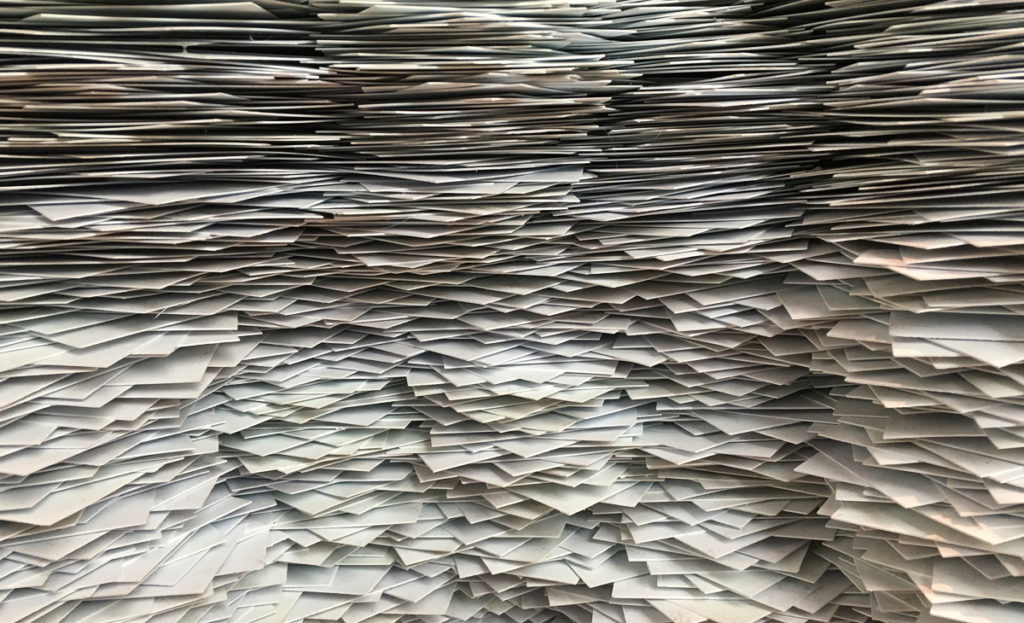

Feeling the urge to purge? Summer’s coming, so it’s likely you’re wrapping up your spring cleaning before your summer fun begins. April 17, 2018 was the deadline for individuals and C-corporations to file their federal income tax returns for 2017 (or to file for an extension). Before you throw out your old financial records, however, […]

Spring Cleaning: When Can You Purge Your Old Financial Records?