It’s long been a policy that employees are exempt from the Fair Labor Standards Act’s minimum wage and overtime protections if they are employed in a bona fide executive, administrative or professional capacity. To fall within this EAP exemption, an employee generally must meet three tests, according to the DOL.

- Be paid a salary, meaning that they are paid a predetermined and fixed amount that is not subject to reduction because of variations in the quality or quantity of work performed

- Be paid at least a specified weekly salary

- Primarily perform EAP duties, as provided in the DOL’s regulations

The DOL’s regulations also provide an alternative test for certain highly compensated employees who are paid a salary, earn above a higher total annual compensation level and satisfy a minimal duties test.

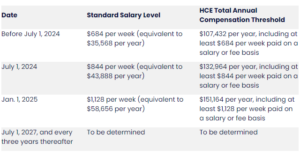

The DOL covers current and future updates of these levels in a chart it has compiled, which is shown below. It’s a helpful reference, but be sure to work closely with payroll and accounting professionals to make sure you’re in full compliance.